- India’s renewable energy surge hinges on modernizing its transmission network.

- Green Energy Corridors and smart grid technologies are reshaping power delivery for reliability, efficiency, and national sustainability goals.

- Flexible AC transmission systems (FACTS), high-capacity transformers, and smart substations improve efficiency

- Market reforms are designed to align electricity prices with grid conditions

India’s clean energy journey has entered a transformative phase, as the country moves steadily toward its ambitious target of 500 GW of renewable energy capacity by 2030.

By June 2025, India had already achieved 235.7 GW of non-fossil fuel capacity, with 226.9 GW from renewable sources and 8.8 GW from nuclear power. This rapid progress underscores India’s national drive toward sustainability, self-reliance, and global energy leadership.

Union Minister for New and Renewable Energy, Pralhad Joshi, recently highlighted that India has surpassed Japan to become the world’s third-largest solar energy generator. However, producing clean energy is only half the equation—the other is transmitting it efficiently to industries, urban centers, and communities across a vast nation. The grid system is now the backbone of India’s energy transition.

The Vision of Green Energy Corridors

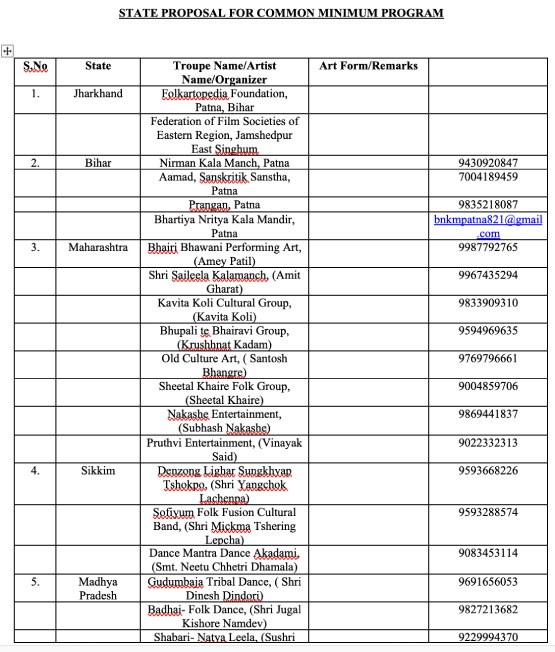

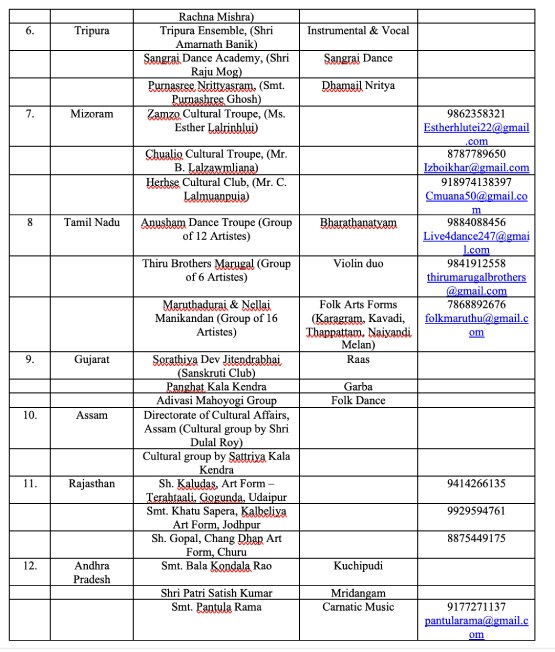

Launched in 2015–16, the Green Energy Corridor (GEC) is a strategic initiative to integrate renewable power—solar, wind, hydro, and tidal — into the national grid. Covering eight renewable-rich states including Tamil Nadu, Gujarat, Himachal Pradesh, Andhra Pradesh, Madhya Pradesh, Karnataka, Maharashtra, and Rajasthan, the GEC ensures both inter-state and intra-state connectivity.

Power Grid Corporation of India Limited (PGCIL) manages inter-state networks, while state utilities oversee intra-state lines.

The corridor’s first phase involved installing around 9,700 circuit kilometers of transmission lines and substations capable of handling 22,600 MVA of capacity. With a ₹10,041 crore ($1.2 billion) investment from central grants, state equity, and international financing — including support from Germany — the GEC facilitates the grid integration of approximately 20 GW of renewable energy, strengthening India’s power infrastructure.

Technology Driving a Smarter Grid

Renewable energy generation is variable and decentralized. Solar output peaks during daylight hours, wind fluctuates with weather, and hydro varies seasonally. To manage this, India’s grid is evolving into a flexible, intelligent system powered by advanced technologies.

Flexible AC transmission systems (FACTS), high-capacity transformers, and smart substations improve efficiency, while AI-powered forecasting and real-time sensors help operators manage load fluctuations and prevent congestion.

Energy storage solutions, such as grid-scale batteries and pumped hydro systems, balance supply and demand, storing excess power and releasing it when needed. With the rise of electric vehicles, rooftop solar, and distributed energy resources, the grid is now a bidirectional ecosystem where consumers can also act as producers. Automation ensures smooth energy flows, maximising renewable penetration nationwide.

Policy Support for Grid Modernization

India’s grid transformation is bolstered by strong policy frameworks. The National Smart Grid Mission (NSGM) and Smart Meter National Program (SMNP) have enhanced transparency, improved demand-side management, and reduced system losses. Over 20 million smart meters have been deployed, giving consumers real-time insights and encouraging energy efficiency.

Market reforms, such as Locational Marginal Pricing (LMP), are designed to align electricity prices with grid conditions, incentivizing generation where power is most needed.

These mechanisms encourage investment in storage, flexible transmission, and advanced forecasting, creating a fertile environment for private-sector participation while ensuring infrastructure keeps pace with renewable growth.

Building a Resilient Grid Ecosystem

The energy transition is more than replacing fossil fuels — it requires rethinking the power system for decades to come. Growing adoption of clean energy in industries, transport, agriculture, and commercial sectors, along with energy-intensive data centers, demands a robust, scalable, and resilient grid.

Predictive maintenance, digital monitoring, and automated response systems are modernizing operations, while microgrids, integrated storage, and digitally managed distribution networks enhance reliability and resilience.

Grid as the Cornerstone of India’s Energy Future

India’s clean energy ambitions depend not only on generation but on efficient transmission and consumption. The Green Energy Corridor, combined with modern grid technologies and policy support, lays the foundation for a resilient and intelligent national grid.

This ensures that every unit of renewable energy reaches its destination reliably, powering industries, energizing communities, and driving India toward a sustainable, prosperous future.

The DP World ILT20 has rapidly emerged as one of the world’s premier franchise cricket tournaments, attracting top-tier international talent and providing a high-profile platform for emerging regional players. The league, held annually in the United Arab Emirates, features six dynamic franchises: Abu Dhabi Knight Riders, Desert Vipers, Dubai Capitals, Gulf Giants, MI Emirates, and Sharjah Warriors.

The DP World ILT20 has rapidly emerged as one of the world’s premier franchise cricket tournaments, attracting top-tier international talent and providing a high-profile platform for emerging regional players. The league, held annually in the United Arab Emirates, features six dynamic franchises: Abu Dhabi Knight Riders, Desert Vipers, Dubai Capitals, Gulf Giants, MI Emirates, and Sharjah Warriors.